To file your IFTA fuel tax, you’ll need:

We make gathering and submitting this data easy through our secure online platform.

IFTA reports are filed quarterly, typically in:

Don’t wait until the deadline, start your IFTA filing today to stay

compliant and stress-free.

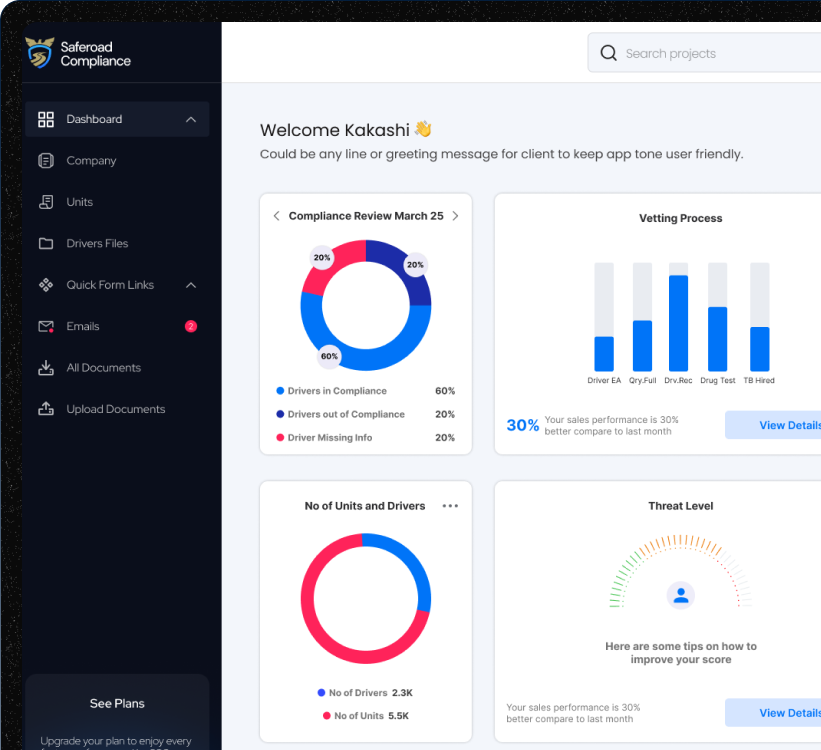

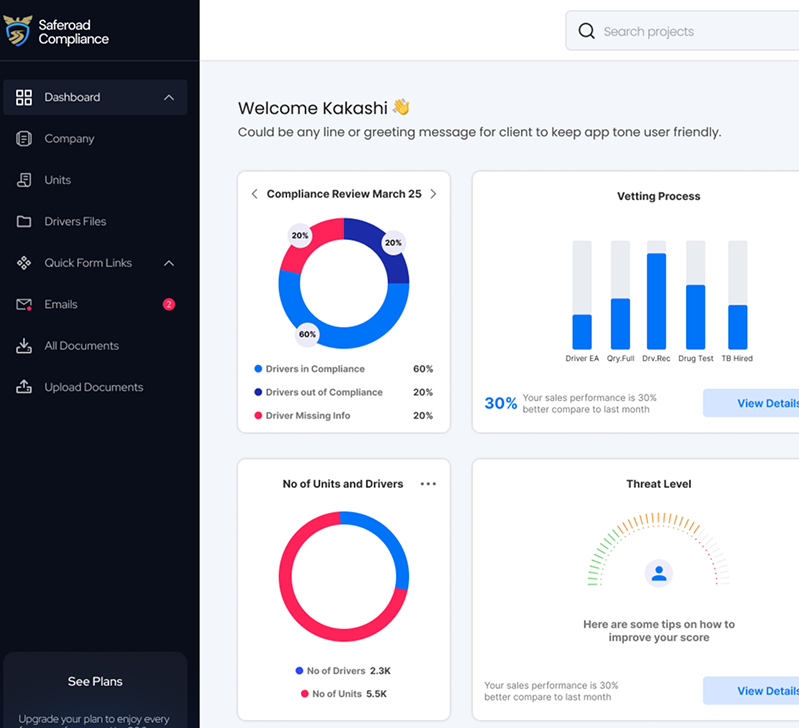

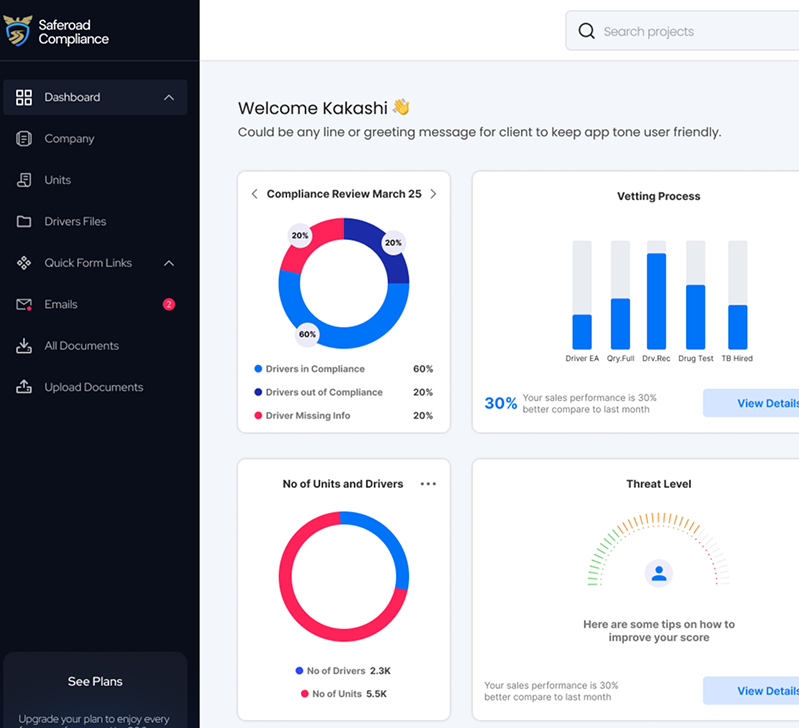

Filing your IFTA fuel tax doesn’t have to be confusing. At SafeRoad Compliance, we simplify your compliance process with:

Accurate Calculations – Every jurisdiction’s fuel use and miles are precisely calculated.

On-Time Submissions – Never miss a quarterly deadline again.

Nationwide Service – Trusted by fleets and carriers across the U.S.

Experienced Team – Compliance specialists dedicated to accuracy and support.

When you choose us, you’re choosing reliability, expertise, and peace of mind.

Our IFTA tax filing online process is quick, transparent, and efficient:

This means less paperwork and more time to focus on your business.

The International Fuel Tax Agreement (IFTA) simplifies fuel tax reporting for carriers operating in multiple U.S. states or Canadian provinces.

It allows carriers to file one consolidated report instead of separate state filings.

You must file IFTA if you:

Failure to complete IFTA reporting leads to audits, penalties, and possible suspension of your IFTA license

Late IFTA filing can be costly. Non-compliance may result in:

Filing on time protects your business and your operating authority.

Let SafeRoad Compliance handle your IFTA tax filing online before the deadline.

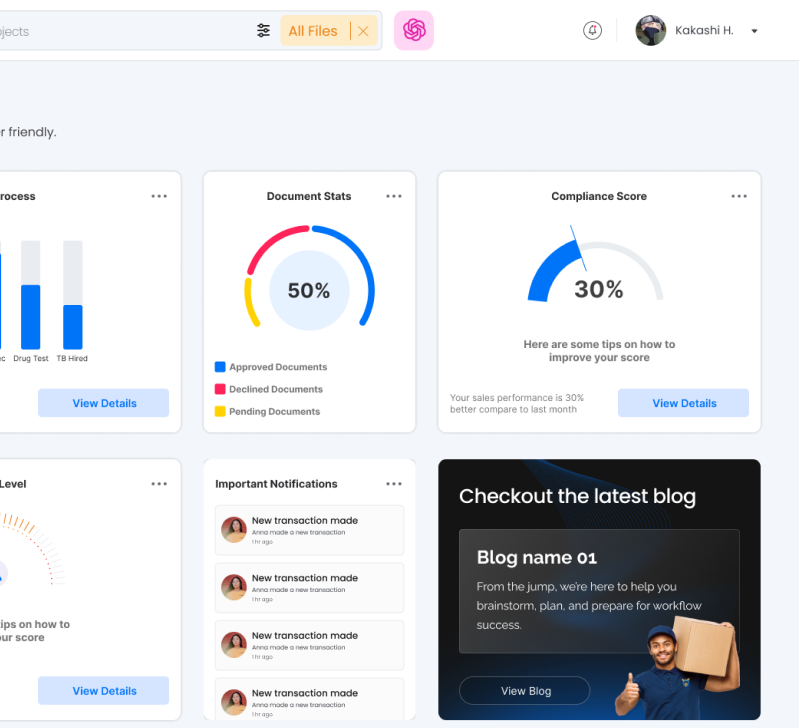

At SafeRoad Compliance, we make DOT compliance simple, reliable, and proactive. With deep industry experience and FMCSA expertise, we help carriers across multiple states avoid fines, reduce operational risk, and stay audit-ready.

Whether you’re a solo driver or managing a growing fleet, we tailor our services to your specific needs—so you can stay focused on running your business.

UCR registration opens October 1st, 2025 and closes on December 31st, 2025, covering the entire 2026 calendar year. Enforcement begins January 1, 2026, and late filings expose carriers to immediate roadside penalties or even out-of-service orders.

You could face penalties, fines, and potential suspension of your authority. SafeRoad Compliance can help you with late filings.

Your USDOT number, company details, and number of commercial motor vehicles.

Yes, we provide end-to-end UCR registration services, ensuring full compliance with DOT requirements.

At SafeRoad Compliance, we’re more than a testing consortium—we’re your dedicated DOT compliance partner. From UCR filing and BOC-3 to IFTA reporting and drug & alcohol consortium enrollment, our team ensures every part of your compliance process runs smoothly.

Join the growing number of carriers who trust SafeRoad Compliance to keep them compliant, confident, and on the road.

We’d love to learn more about

you and what we can design

and build together.